IRS 14157 2018-2025 free printable template

Show details

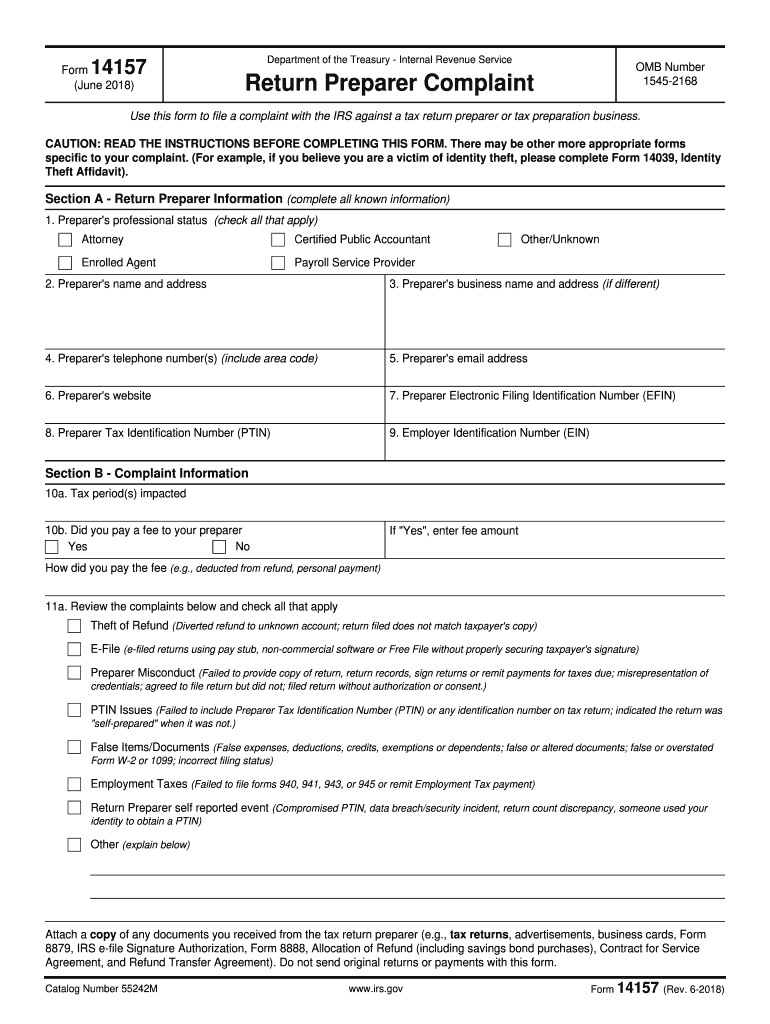

Submit both forms along with the documents listed in the Form 14157-A instructions to the address indicated on the Form 14157-A. Do not send original returns or payments with this form. Catalog Number 55242M www.irs.gov Form 14157 Rev. 6-2018 Page 2 11b. Where to Send This Form If a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account complete Form 14157-A Tax Return Preparer Fraud or Misconduct Affidavit in addition to...

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS Form 14157

Detailed Instructions for Editing IRS Form 14157

Guidelines for Completing IRS Form 14157

Understanding and Utilizing IRS Form 14157

The IRS Form 14157 plays a critical role for tax professionals and taxpayers in addressing erroneous tax filing positions related to abusive tax schemes. This form allows individuals to report their participation in these schemes while ensuring compliance with IRS regulations. Proper understanding and usage of Form 14157 can protect individuals from severe penalties and promote accurate tax reporting.

Detailed Instructions for Editing IRS Form 14157

To effectively edit IRS Form 14157, follow these step-by-step guidelines:

01

Obtain the latest version of IRS Form 14157 from the IRS website.

02

Carefully read the instructions included with the form to understand the requirements.

03

Fill in your personal information accurately, ensuring all spelling and numbers are correct.

04

Review any sections that require specific details about the abusive tax scheme.

05

Double-check your entries to avoid common mistakes, such as incorrect Social Security numbers.

06

Finalize the form by signing and dating it at the bottom.

Guidelines for Completing IRS Form 14157

Completing IRS Form 14157 requires attention to detail. Here’s how to fill it out correctly:

01

Identify the type of abusive tax scheme you were involved in and provide evidence if available.

02

Specify the year(s) involved in the transaction as accurately as possible.

03

Include any additional documentation that supports your claim of participation and the reasons for filing this form.

Show more

Show less

Latest Updates and Changes to IRS Form 14157

Latest Updates and Changes to IRS Form 14157

Recently, the IRS made several significant updates to Form 14157 that tax professionals and affected individuals should know:

01

The inclusion of additional qualifying abusive tax schemes.

02

New guidance regarding the types of documentation required for reporting.

03

Changes in submission methods that may offer more flexibility for electronic filing.

Essential Insights into IRS Form 14157

What Exactly is IRS Form 14157?

Understanding the Purpose Behind IRS Form 14157

Who is Required to Fill Out IRS Form 14157?

Conditions that Allow for Exemptions

Understanding Filing Deadlines for IRS Form 14157

Contrasting IRS Form 14157 with Similar Forms

Types of Transactions Covered by IRS Form 14157

Required Copies for Submission of IRS Form 14157

Consequences of Failing to Submit IRS Form 14157

Essential Information Needed to File IRS Form 14157

Forms That May Accompany IRS Form 14157

Submission Address for IRS Form 14157

Essential Insights into IRS Form 14157

What Exactly is IRS Form 14157?

IRS Form 14157 is designed for taxpayers to disclose their involvement in abusive tax schemes. It serves as a mechanism for reporting erroneous or questionable tax positions and can help mitigate severe penalties associated with such activities.

Understanding the Purpose Behind IRS Form 14157

The primary purpose of IRS Form 14157 is to allow taxpayers to self-report their involvement in tax schemes that compromise their tax filings. By voluntarily disclosing this information, individuals can potentially reduce penalties and avoid prosecution.

Who is Required to Fill Out IRS Form 14157?

This form is typically completed by individuals who have participated in abusive tax schemes. This can include taxpayers who have utilized certain tax shelters or structures deemed abusive by the IRS. If you received any correspondence from the IRS regarding your participation, it is essential to file this form.

Conditions that Allow for Exemptions

Exemptions for filing IRS Form 14157 can apply under certain conditions. Here is a list of qualifying situations:

01

Your adjusted gross income falls below established thresholds.

02

The transaction was carried out in specific industries, such as non-profits, where the rules may differ.

03

You can provide documentation proving legitimate reliance on professional advice regarding the tax scheme.

Understanding Filing Deadlines for IRS Form 14157

Typically, IRS Form 14157 must be filed within three years from the date the transaction occurred or when you filed your return that included elements of the abusive scheme. Depending on local tax laws, additional deadlines may apply, so it's crucial to consult current IRS guidelines or a tax professional.

Contrasting IRS Form 14157 with Similar Forms

IRS Form 14157 is closely related to several other forms, including:

01

IRS Form 14157-A: A simplified form for individuals who want to request removal from an abusive scheme.

02

IRS Form 8888: This is for those distributing refunds to multiple accounts but not specifically addressing abusive schemes.

Types of Transactions Covered by IRS Form 14157

The types of transactions that require the submission of Form 14157 typically include:

01

Transactions that involve tax shelters promoting fictional losses.

02

Any scheme focusing on offshore accounts or gullibility traps.

03

Involvement in arrangements that provide significant but illegitimate tax benefits.

Required Copies for Submission of IRS Form 14157

When submitting IRS Form 14157, taxpayers are required to send one signed original to the IRS, along with any necessary documentation. Keep copies for your records to ensure proper tracking and compliance.

Consequences of Failing to Submit IRS Form 14157

The penalties for not submitting IRS Form 14157 can be severe. Examples include:

01

Financial penalties up to 20% of the understated tax for the period in question.

02

In some cases, criminal charges can be brought forth for willful negligence.

03

Eligibility for innocent spouse relief might be forfeited if you fail to report.

Essential Information Needed to File IRS Form 14157

Before filing, gather important details, such as:

01

Your full personal information, including social security or taxpayer identification number.

02

Details of the scheme involved, including dates and transaction descriptions.

03

Any supporting documents that outline the nature of your involvement.

Forms That May Accompany IRS Form 14157

If applicable, other forms you may need to submit alongside IRS Form 14157 include:

01

IRS Form 14157-A: If you are opting to self-identify as a participant to mitigate penalties.

02

IRS Form 8862: If you are seeking to claim lost credits due to participation in the scheme.

Submission Address for IRS Form 14157

Submit IRS Form 14157 to the address specified in the instructions provided with the form. Ensure to double-check any local or updated addresses as they can change yearly. Using certified mail can provide proof of submission.

Understanding and accurately completing IRS Form 14157 is vital for compliance and protection against penalties. If you're unsure about your situation, consider consulting with a tax professional or using a reliable tax preparation service to guide you through the process.

Show more

Show less

Try Risk Free